If you’ve seen reports saying the average cap rate is “6%” and thought, “That doesn’t line up with what I’m seeing,” you’re not wrong.

Cap rates are one of the most talked-about metrics in commercial real estate—but when applied too broadly, they can create more confusion than clarity. This is especially true in niche sectors like RV and mobile home parks, where asset quality, location, and demand can vary dramatically.

Let’s break down what you really need to know.

The capitalization rate (cap rate) is a tool investors use to estimate the return on a real estate investment, based on the property’s income and purchase price.

A higher cap rate often signals a riskier or less desirable property with more upside potential, while a lower cap rate usually indicates a higher-quality asset in a strong location that commands a premium price.

But here’s the catch: there is no one-size-fits-all cap rate. The idea of an “average cap rate” is only helpful as a starting point.

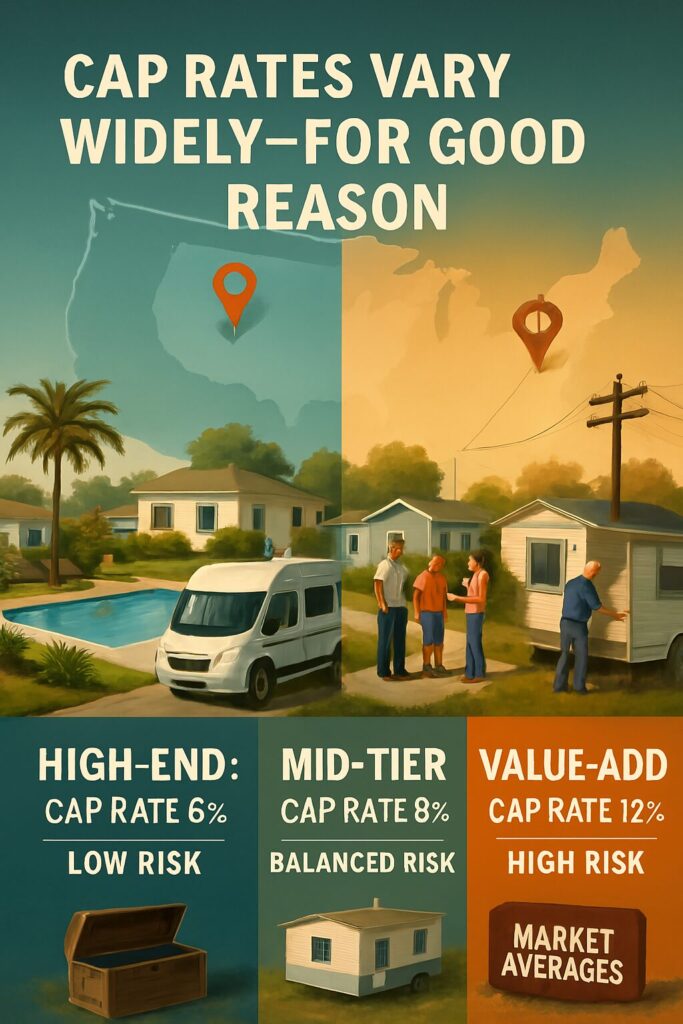

In the RV and mobile home park sector, the range of cap rates is wide—and for good reason. Different property types, tenant bases, and markets create different risk profiles.

Here’s a general breakdown of current cap rate ranges in the space:

Nationally published cap rate averages are often too generalized to be helpful to an individual park owner. They blend together all types of properties across all market tiers and fail to account for:

This is why relying on “the average” can mislead owners into overpricing or underpricing their assets—or worse, making a poor investment decision.

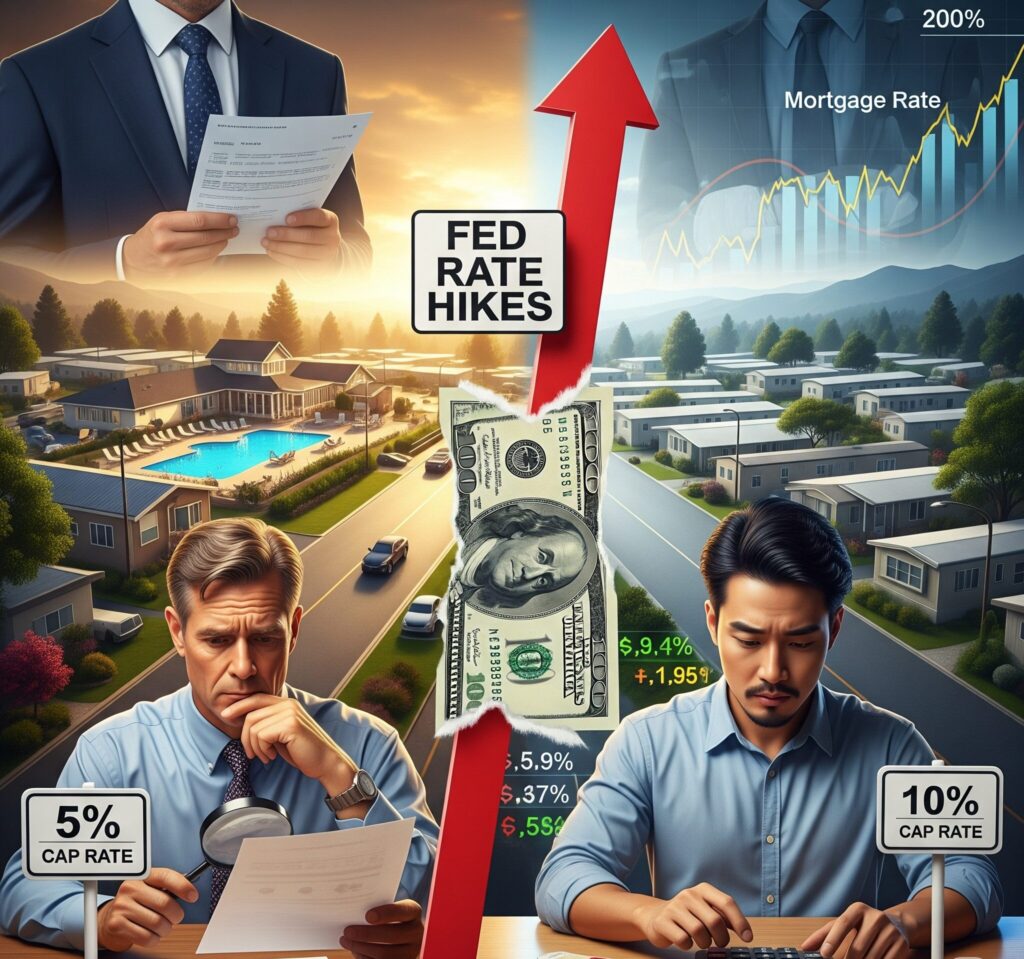

In today’s higher interest rate environment, buyers are more cautious, and the cost of debt has risen significantly. As a result, the difference in cap rates between premium parks and value-add properties has widened.

A clean, well-run MH community in a high-growth area might still trade near 5%–6%, while an RV park with operational challenges might trade above 9%. Understanding where your park falls in that range is critical if you’re thinking about selling, refinancing, or buying.

You should either sell now or plan to hold for another 12–18 months—or longer.

As debt becomes more expensive, buyers are demanding higher returns (higher cap rates), which puts downward pressure on prices. If you’re not prepared to meet the market today, you’ll likely need to wait until economic conditions stabilize before re-entering with stronger pricing expectations.

Know where your property sits on the cap rate spectrum.

Is your park best-in-class for the market? Or does it need repositioning or investment to be competitive? Knowing this helps you make better decisions around refinancing, capital improvements, or future disposition timing.

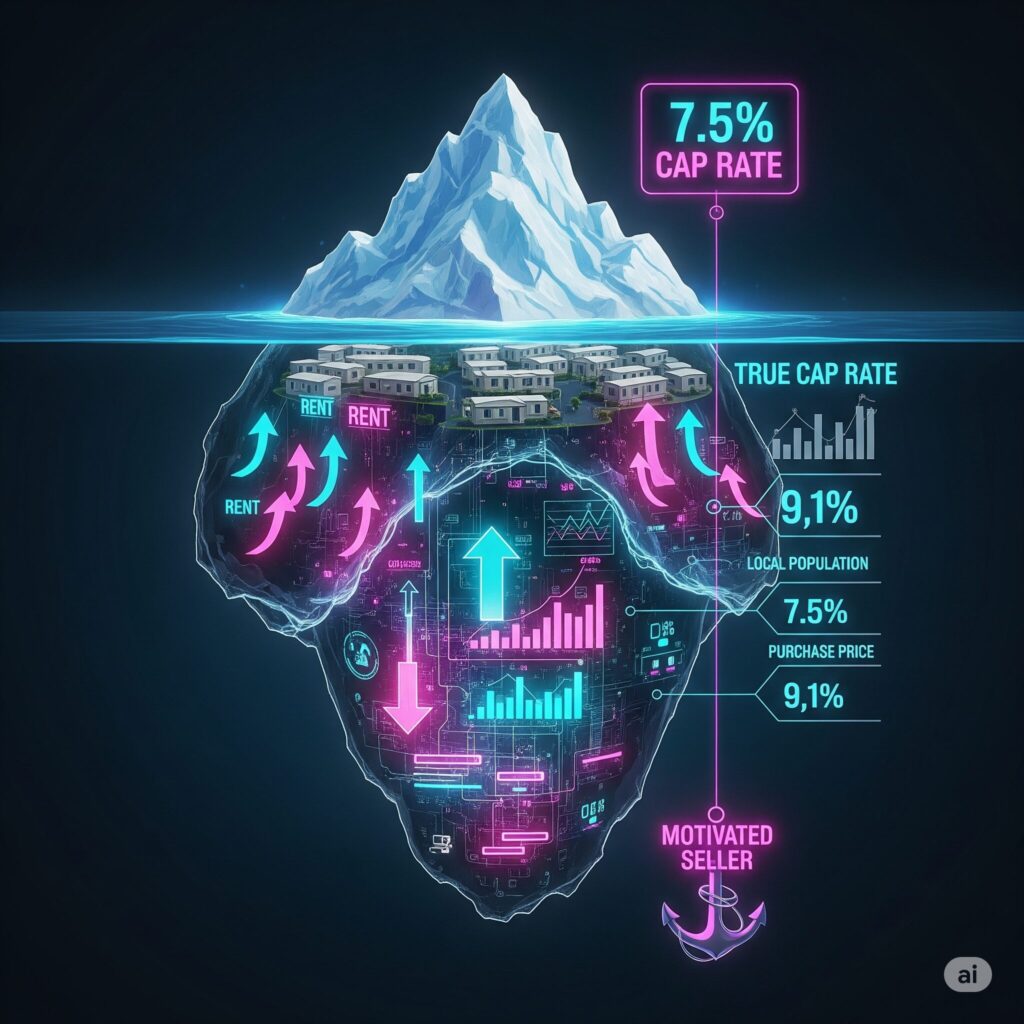

Don’t fixate on the average—buy based on fundamentals.

Look for mispriced deals based on local growth, infrastructure quality, rental upside, or seller distress. Just because a park is marketed at a 7.5% cap rate doesn’t make it a deal—dig deeper into the numbers and the story.

“Average cap rates” can be a helpful benchmark for gauging the market—but they’re not a substitute for real insight.

If you’re an RV or mobile home park owner, the most valuable thing you can do is look beyond the surface. Understand what’s driving demand in your specific market, how buyers are underwriting deals, and what real investors are paying today.

In this market, use a shovel, not a rake—the deeper you dig, the more opportunities you’ll find.

If you’d like a free valuation or just want to understand where your park fits in today’s market, ⏬

What Happened: Moody’s Downgrades U.S. Credit Rating

POST TACO 2025 RECAP

Strategic Partners of the Outdoor Hospitality Industry