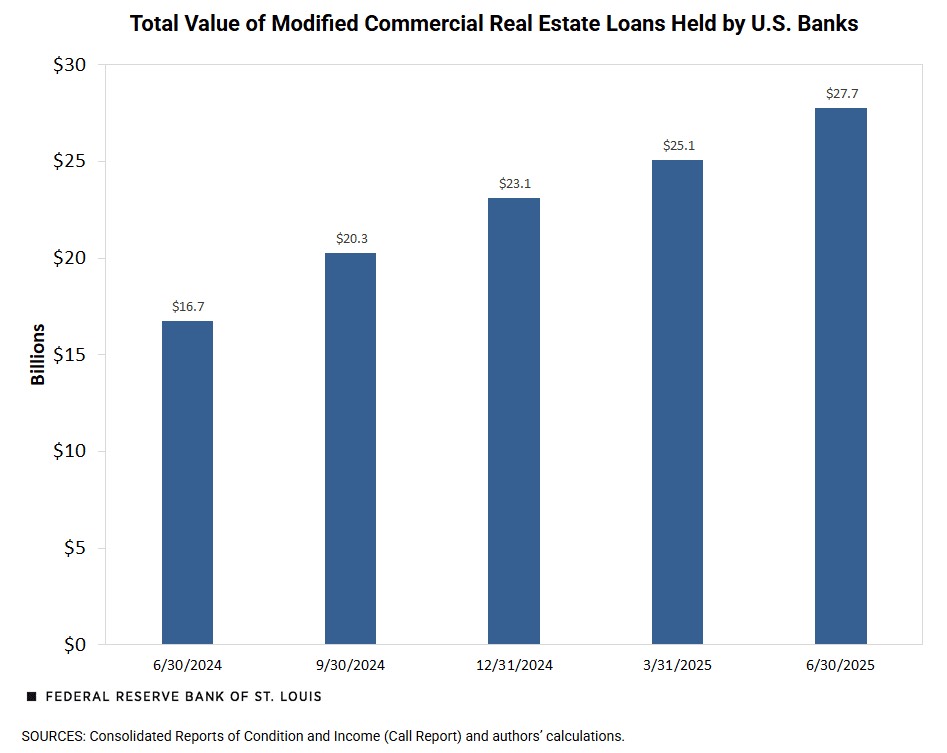

Across the U.S., banks are bracing for mounting losses as a wave of commercial real estate (CRE) loan modifications surges through the market. The Federal Reserve Bank of St. Louis reports that the value of modified CRE loans has jumped 66% year-over-year, as lenders scramble to “extend and pretend” — prolonging loan terms to delay inevitable losses while hoping market conditions improve.

But what does this mean for the outdoor hospitality sector — RV parks, mobile home communities, and campgrounds — where financing has already become increasingly complex?

A Perfect Storm of Debt, Rates, and Oversupply

The combination of rising interest rates, tightened lending standards, and falling property values has created a credit squeeze across commercial real estate. For outdoor hospitality operators, the impact is even sharper. Many properties purchased or refinanced during the 2020–2022 low-rate window are now approaching maturity with loans that simply won’t pencil under today’s debt conditions.

At the same time, the sector has experienced rapid overdevelopment — especially in RV parks and campgrounds — fueled by pandemic-era demand and cheap capital. The influx of new supply has begun to saturate markets, driving down occupancy and daily rates in many areas. Combined with elevated operating expenses (labor, insurance, utilities, and maintenance), many properties are seeing compressed net operating income (NOI) right when their debt is coming due.

Why Refinancing Is Becoming More Difficult

With values under pressure and NOI slipping, refinancing options are dwindling. Banks, already in a defensive stance, are increasing reserves and focusing on lower-risk lending segments. Many are opting to modify existing loans rather than take on new exposure — but this “extend and pretend” approach only buys time, not stability.

Borrowers who financed aggressively at sub-4% rates are now facing refinance terms closer to 7–8%, often with stricter DSCR (Debt Service Coverage Ratio) requirements and lower loan-to-value thresholds. For outdoor hospitality assets — where income can be seasonal and variable — these metrics are even harder to meet, leaving owners few good options.

Selling Isn’t Always the Escape Valve It Once Was

Historically, when refinancing became difficult, many owners turned to the market to sell. But in the current environment, buyers are facing the same lending headwinds, and cap rates have adjusted upward in response to higher borrowing costs. The result: a pricing gap between what sellers believe their properties are worth and what buyers can actually afford to pay.

In markets that have seen overdevelopment — especially in Texas, Florida, and parts of the Southeast — this disconnect is widening. Properties that once traded at premium valuations during the boom are now sitting longer, seeing price reductions, or being pulled off the market altogether.

The Road Ahead: Caution and Opportunity

For operators and investors, this looming maturity wall represents both a risk and an opportunity. Distress will rise among over-leveraged owners and newer developments with limited operational history. However, well-capitalized buyers who can transact without heavy reliance on debt may find themselves in a position to acquire high-quality assets at more reasonable pricing.

In this next phase of the cycle, fundamentals matter more than ever:

- Strong in-place cash flow and consistent seasonal demand will separate stable assets from speculative ones.

- Properties with diversified revenue streams (RV + cabins + long-term stays) will fare better than single-format developments.

- Clean financials, accurate data, and professional operations will be critical for attracting lenders and buyers alike.

The Bottom Line

The outdoor hospitality sector isn’t immune to broader CRE trends — in fact, it may feel them more acutely. As banks brace for losses and refinancing hurdles grow, owners and investors should prepare for a more disciplined, data-driven market. Overdevelopment, declining revenue performance, and rising capital costs are converging to redefine what “stability” looks like in the years ahead.

Previous Post

New 2,313-Site RV Park: What It Is, Why It’s Coming, and What It Means for Texas

Next Post

Why Self-Storage Remains One of the Most Reliable Investments in Commercial Real Estate