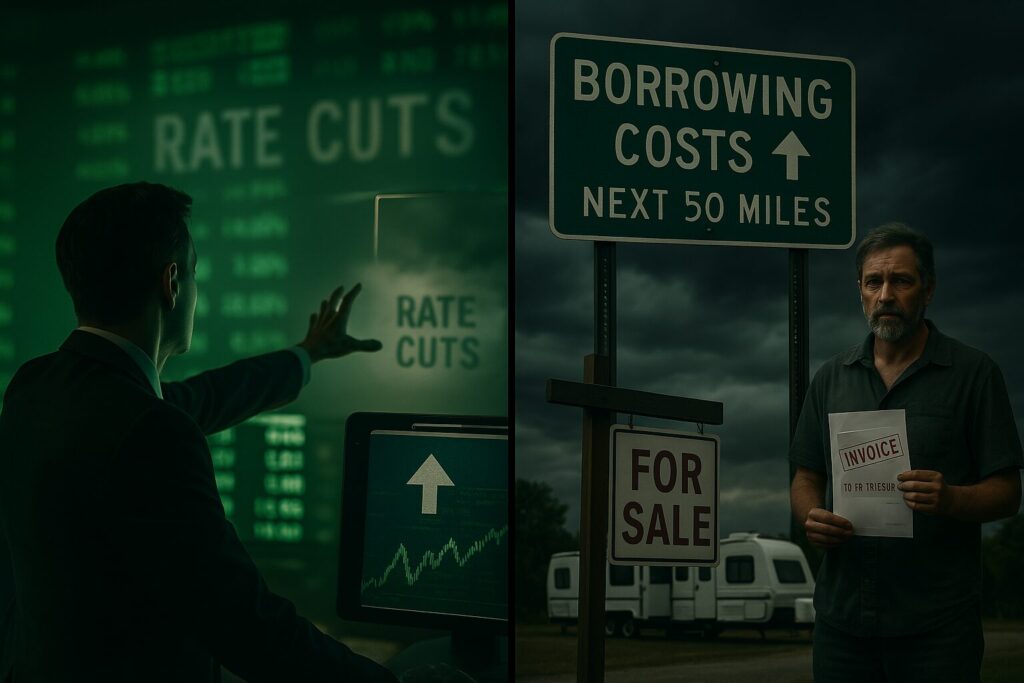

As we move through the year, one of the biggest questions weighing on the minds of real estate investors—especially those in outdoor hospitality—is: Where are interest rates heading?

Whether you own an RV park, a mobile home community, or a glamping resort, rising or falling rates directly impact what your property is worth, how easily a buyer can finance it, and how attractive it is to the investment market.

The 10-Year Treasury Is Driving CRE Lending—and It’s Under Pressure

The 10-year Treasury rate—often the benchmark for commercial real estate loans—has hovered in the 4.5% range so far this year. But many economic signals are pointing toward further upward pressure, with forecasts pushing the rate toward or even above 5% by year-end.

There’s a long list of reasons for this:

- Federal budget uncertainty and an expected $1.9 trillion deficit in 2025 mean the government will need to issue more Treasuries to fund spending.

- Shrinking demand: Major buyers of U.S. debt like China and Japan are pulling back. The Fed itself is reducing its balance sheet by letting $60 billion of Treasuries roll off every month.

Political and trade tensions, combined with international capital flowing out of U.S. debt, are all contributing to volatility.

For RV park and mobile home park owners considering a sale or refinancing, this matters because higher Treasury rates usually mean higher loan rates—and lower buyer purchasing power.

What About the Fed?

While Wall Street still holds out hope for rate cuts later this year, I wouldn’t count on it. Inflation remains sticky, especially in areas affected by trade and energy policy. Even if the Fed were to cut its short-term rate, the 10-year Treasury might not follow suit.

There’s no guarantee of relief in borrowing costs in the near term. In fact, it may get more expensive.

What This Means for Sellers

If you’re thinking about selling your park this year, waiting may not work in your favor. When interest rates go up, capitalization rates (cap rates) tend to rise too—at least eventually—which means sale prices come down.

The buyers who can still transact in this climate are the ones who are well-capitalized or looking for assets where they can quickly add value through improved operations, capital improvements, or better marketing. But even they are watching interest rates carefully.

Bottom line: If you’re on the fence about selling, it may be smarter to move now before another potential rate hike erodes your sale price.

What This Means for Buyers

If you’re in acquisition mode, this market rewards action—but with discipline. Waiting for prices to fall in lockstep with rate hikes is risky. That correlation is not linear. A better move is to seek out parks with value-add potential where you can create upside: submeter utilities, upgrade sites, improve marketing, add cabins, bring in managers, or fix deferred maintenance.

Today’s market still offers opportunities for positive leverage—where the cap rate is higher than the loan rate—but they are getting harder to find. If you’re underwriting deals today, assume rates could go higher before they come down. Lock financing early where possible.

Keep Your Eye on the Horizon

RV and mobile home parks are long-term plays. If your hold horizon is 3, 5, or 10 years, then short-term rate noise shouldn’t be the only factor driving your decisions. The best operators are finding ways to grow NOI, strengthen tenant retention, and make their properties irreplaceable in their local market.

We don’t control interest rates, but we do control how we operate, when we act, and how we position our assets

Also featured on Woodall’s Campground Magazine — Read the article on their website here.

Previous Post

RV and Mobile Home Park Due Diligence: What to Know

Next Post

TINY HOMES, BIG OPPORTUNITY: Integrating Tiny Living into RV & MH Parks